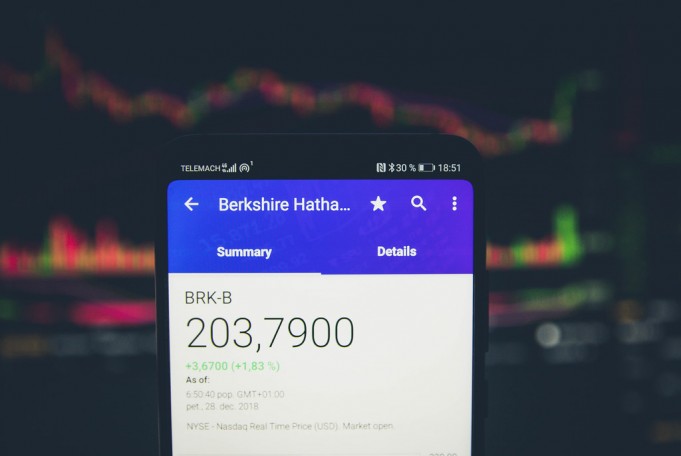

Will Berkshire Hathaway beat S&P 500 in the near future?

Warren Buffett’s Berkshire Hathaway is still one of the premier companies and inspirations for investors. Indeed, there is lagging in the stock market for the company, but it still manages to be consistent over time. In 2019, S&P 500 beat Berkshire Hathaway by 20% whereas Berkshire Hathaway rose to 1%. This results in two-fifth’s of the stock investment of Berkshire Hathaway being sold by major holders. After the S&P 500 reaches its heights, the major holder share of Berkshire Hathaway is lagging the market.

Is the Buffett magic gone?

Warren Buffett was criticized for not beating the market over the decade. He says it is difficult to beat the market since everything is priced in. Buffett suffered a reputational and financial loss in 2019, due to the 1-billion-dollar paper loss. As a result, one of the largest investments sank. The company posted a 15.4-billion-dollar write-down for its Kraft and Oscar Mayer Brands to compensate for the loss.

What is the future for Berkshire Hathaway?

Warren Buffett is a better investor than everybody, and not everybody is competent enough to buy companies when it goes on sale. When the market tanks and fear rules, Buffett steps in while others run away from the loss. In 2014, when Tim Hortons picked Berkshire Hathaway shares, that started to crush the market. The company destroyed the reputed brand, and while other stocks were going well, Tim Hortons made the decline.

Right now, Warren Buffett has approximately 150 billion dollars in cash that are almost one-third of the value of Berkshire Hathaway. It consists of 70% stock and private holding and the rest is cash and incomes. Right now, the primary goals are to adjust the return, but being a strategic investor, Warren Buffett is waiting for the market to go on sale and that time Mr. Buffett will buy companies that would elevate the shares shortly. The 150 billion dollars is going to create a huge impact on the company in a few years. Investing has many risks as the graphs are still on the recession. He is waiting with the money to teach the market and investor a great lesson.

The 89 year old investor has to step down from the CEO, and that might affect the company in more than one way. The two Berkshire Hathaway executives Greg Abel, Berkshire Hathaway, or Ajit Jain, Chairman of Berkshire Hathaway insurance operations “…have to take the lead and are competent enough to succeed him as CEO”, stated Mr. Buffett in 2015. Also, he stated that they will resume the job after he dies or steps down.

Conclusion

In the past year, Berkshire Hathaway shares lagged the S&P 500 index, which has considerably scaled with the economy for the past decade. The broader economy has been underperforming in the past few years. Amidst its comprehensive access to companies that have been struck by the coronavirus crisis, it remains to be seen when it can recover.