Spend Less Than You Earn

When it comes to personal finance, and spending less than you earn, you must build your mind to think wisely. The biggest asset you must have is control over your financial situation, and then you’ll really make progress. If you have the mindset but no strategy to follow to build wealth, you have no control over your situation. Plan simple and to really make progress you have to believe that it can be done and that all things are possible.

With this single thought, you can dig yourself out of whatever situation you are in –you can expect instant results. You can move in the right direction every day, which will eventually ease out and make you financially sound. Don’t focus too much on frugality, it always comes naturally to derive much joy from spending money. However, don’t deprive yourself either, strike that balance where I buy what I want but in smart ways.

If you’re currently spending more money than you earn you need to focus on getting that aspect under control right away. Because if you earn more money and spend it all – what’s the point? It makes no sense at all.

Be aware financially

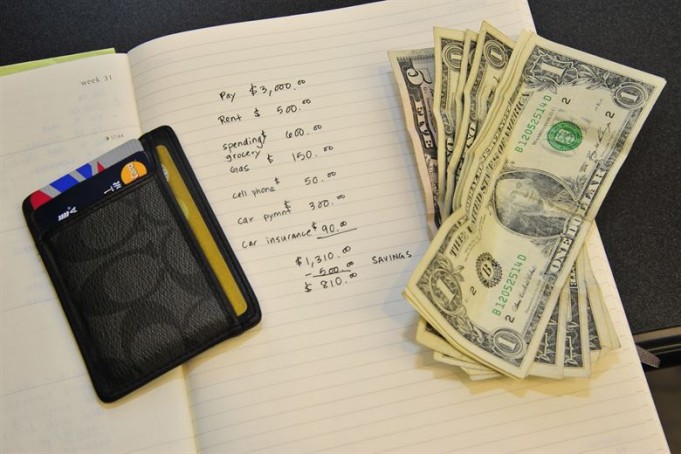

There are many people who are in complete denial about their financial situation and yet are always scheming up new things to go into debt. They are up to their eyeballs in debt, so if this is you please, snap out of it. Go through all of your expenses and write down where you actually stand, and how to get out of it.

- What are your debt levels?

- How much do you spend every month?

- What are your savings?

- What are your dreams?

Know where you stand, don’t blame yourself for past mistakes, or pretend like they don’t exist at all. When you make mistakes you have the ability to self-correct, be 100% honest or no “savings hacks” will do any good. Make your favorite “anti-budgeting” method, and diligently track your expenses. Analyze it to fit naturally with your personality and make sure it lasts.

Take your savings from the top

To spend less than you earn, take your savings from the top, and have certain income streams that are sent to savings. For example, have one for taxes and some for emergency funds which works extremely well. This works great even when you earn less money, though you may have hard time-saving money.

Lower Non-essential Spending

If your financial awareness results in how to spend less on pointless things, then there is no need to take action. You must go about this in a very careful way, and start lowering the amount you are spending on non-essentials. Don’t completely burn yourself out, determine what really cuts you can make, and then keep going until you reach the desired amount. It does not mean that you should never buy things you want, rather, have an intentional plan. This includes financial responsibility as there are some easy ways to spend less without lowering lifestyle.