Credit Score vs Fico Score

A credit score shows where an individual credit stands, whereas the Fico score is widely used by lenders. A Fico score is a brand introduced by Fair Isaac Corporation, US. They are used in 90 percent of US credit lending decisions. A low credit score indicates your credit number. It indicates that money lending companies or banks will look at you as a high-risk investment individual. A Fico score allows you to understand how financial institutions evaluate your credit risk while applying for a loan or credit card.

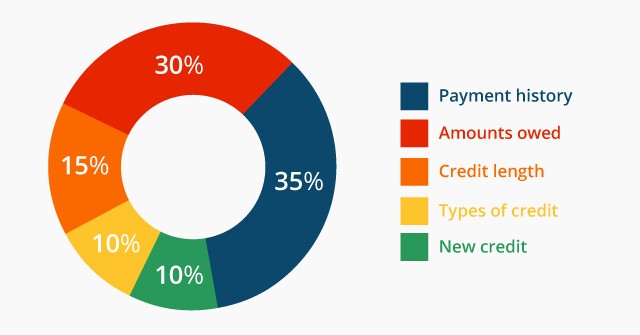

A credit score is a record of the past dealings with the creditors. It includes your name, address and employers. In addition, the history and status of your several credit accounts. There are also the inquiries made by the companies checking your credit report. You will find information from public records, which are bankruptcies, tax liens and civil judgments. Your credit score is determined by five factors. They are as follows:

- Payment History – 35 percent

- Amounts owed – 30 percent

- Length of history – 15 percent

- New Credit – 10 percent

- Credit mix – 10 percent

- Payment History Report

Your payment history is the most important factor when it comes to evaluating your credit rating in credit cards, retail accounts, installment loans, and finance company accounts. It also includes bankruptcy and collection items history. It is the first factor that mainly determines in checking if your past credit payments were made on time. Also, it is viewed across the several types of accounts you may have used at one time or the other. The FICO scoring system checks whether your past credit account payments were on-time. This payment history is reviewed across the different types of accounts a person might have utilized at one point.

Amounts owed to the creditor

The second most important factor in a FICO score is the amount of credit you are using. They are looking at your credit utilization. It includes any outstanding balances that you have on installment or EMI loans compared to the original amount. Credit utilization is the ratio of the balance owed compared to the credit line limit. You control how much you use and a higher credit utilization ratio may point towards difficulties in money management. A long history of demonstrating consistent payments on credit accounts is a good way to show lenders you manage your finances responsibly.

Credit history

The length of time is how long you have had credit is the third most relevant factor. Longer credit history will increase your FICO score. Moreover, to determine the length of credit history, they will consider the age of the oldest account, the age of the newest account, and an average age of all credit accounts. The last time used account is also taken into consideration.

New credit score percentage

About 10 percent of the FICO score is based on the frequency of credit inquiries and new account openings. According to FICO research, someone who opens several credit accounts in a short period of time could be a greater risk investment compared to others. For example, if you are currently looking for an auto, mortgage or student loan.

Credit mix

And finally, a 10 percent FICO score is based on the type of credit in use, such as installment loans, finance company accounts, mortgage loans, and retail store accounts. In this category, FICO takes into account the type of credit accounts on the report and how many establishments you have in total.