Overdraft Protection Plans

Banks may be quick to enroll you in an overdraft protection plan by rationalizing your best financial interests in mind. But these plans are not necessary for everyone, most importantly, overdraft plans are optional. If you’ve opted in to an overdraft protection plan, then you’ll get hit with an overdraft fee to cover a debit card purchase or ATM withdrawal. Even though you don’t have the funds, the bank makes an overdraft, which puts your account into the red. But banks charge hefty fees, usually in the ballpark of $35 per transaction.

Link Additional Accounts to Cover Shortfalls

There are other methods to avoid steep overdraft fees such as linking a savings account to transfer money to cover any shortfalls. This way, enough money will automatically transfer from your linked account to complete the transaction. This safety net doesn’t come free; interest can accrue on top of the transfer fee. But this fee is typically much lower, make sure to do your research on the details of the plans your bank offers.

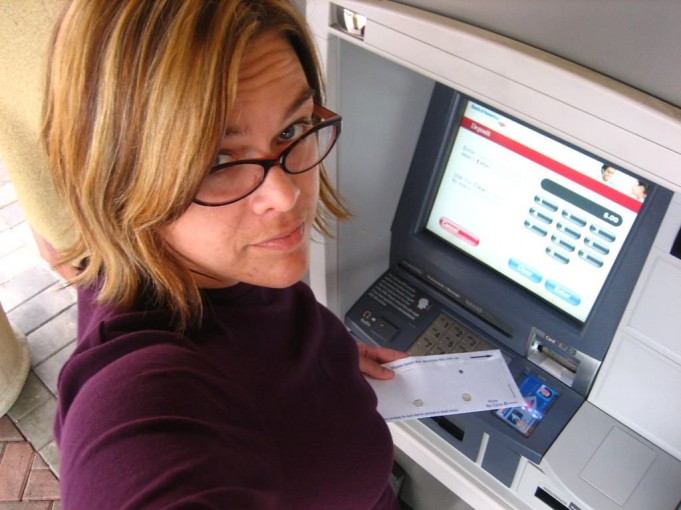

Monitor Accounts Regularly and Signs Up for Account Alerts

The days of banking at branches on weekdays are over; routinely monitor your account and avoid overdraft protection fees. With the convenience of modern banking, you should monitor your debit card, ATM withdrawals, and any automatic bill payments. Most banks offer alerts, including text messages, and emails when you hit a low-balance threshold. Most major banks offer mobile apps; access to your finances is just a thumbprint away.

Create Buffer Cash in Overdraft Protection

If you have room in your budget, keep extra money to act as a shield against overdraft fees. Keeping your minimum account balance is a good way to avoid most overdraft fees. Debit card transactions cause more overdrafts, transactions get declined if there isn’t enough money. But institutions do not charge insufficient funds to avoid overdraft fees for declined debit card attempts.

Understand Your Balance Against Purchases

It’s one thing to know your account balance and another to know how your purchases affect your overdraft fees. Not every transaction is deducted immediately as checks can be cashed on a later day. But, automatic bill-pay lets you choose the day of the payment. Items purchased online can be deducted from the account on the day it is shipped. It is never a bad idea to keep track of your transaction, instead of relying on your bank’s updates.

Avoiding overdraft fees doesn’t have to be complicated for any budget or account balance. Your bank may offer you an overdraft fee protection; make sure the plan protects you and your wallet. Nominal precautions include routinely monitoring your account balances, and maintaining a cash safety net. All of this can help with unwelcome overdraft fees. Be aware of your spending habits and know how to budget your transactions so as not to be in the red.

Empower yourself to make well-informed financial decisions to avoid pushing yourself into a negative balance, so that overdraft fees will never be a part of your financial portfolio. This costly scenario is avoidable if you stop making purchases without credit balance several times.