What is Microfinance?

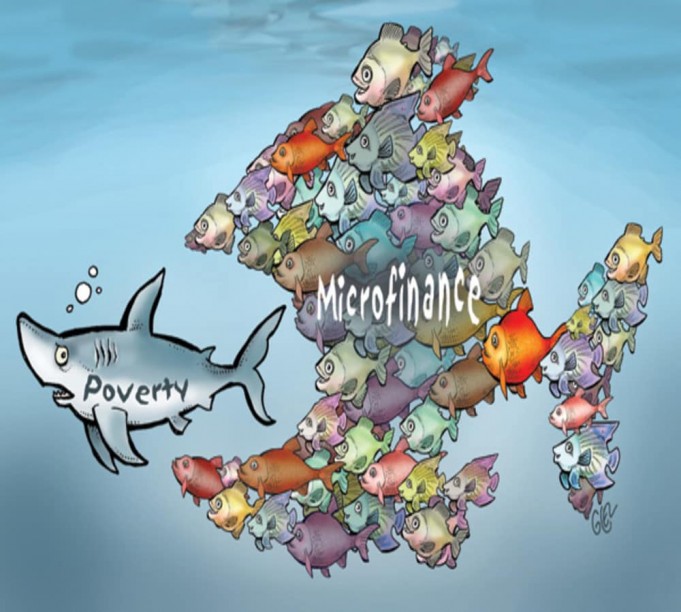

Across developed nations, the best solution for unemployment and poverty was sought in the form of microfinance. Microfinance is the distribution of tiny micro-credits used by the vulnerable for performing income-generating activities. Microfinance was introduced by US-trained Bangladeshi economist and 2006 Nobel Peace Prize laureate Dr. Muhammad Yunus.

Microfinance delusion comes by promoting self-help and private empowerment. By indirectly discrediting other types of joint action, such as labor unions, mass movements, cooperatives, public investment. Microfinance is a joint effort to achieve a fairer allocation of income and resources. Without microfinance,

progressive politicians in the international environment world have sunk into the past.

Facts about microfinance

The microfinance challenges are deep and multifaceted. It was believed that in the beginning, no matter how many informal microenterprises get supported into existence, there would still be ample local demand. This would immediately consume the increased local supply of basic goods and services.

Except in the 1970s, local neighborhoods in most developed countries were a hive of illegal interaction with the most basic things and facilities received relatively sufficiently by the poor inhabitants of a city. Therefore, an artificially driven production rise was often going to produce a very little gain in terms of new employment and profits. Alternatively, grabbing more and more informal micro-enterprises into the same local economic space usually leads to ‘displacement.’ The additional supply often appears to suppress the prices of the local goods and services involved, thereby affecting all (new and incumbent) microenterprises adversely.

Jobs generated by microfinance in the local community

Another way to look at it is to essentially make the current population of poor micro-entrepreneurs pay the bill. They can pay the bill in the form of reduced wages for the few net jobs generated by microfinance in the local community.

Microenterprises are, by definition, ‘poverty-push’ even more than small to medium-sized businesses. Therefore, we continue to see a very high rate of failure for these business units. This suggests that microfinance can produce far less viable job growth in the longer term than is normally seen. Loss most often ensures that the weak suffer the devastating destruction of major money. Community funds are first collected from families, and remittance revenue continues to transfer and repay their microloan.

Need to sell valuable properties

The need to sell valuable properties (often at fire-selling prices) such as supplies, machinery, motor cars, housing, and the land is therefore not necessary. Low-income families all too frequently fall into deeper, and often irretrievable, deprivation as they lose those possessions.

The vast majority of microfinance is not used to power the growth of micro-enterprises, but simply promotes basic spending on consumption. This psychology also tends to account in an increasing number of developed countries for the rapid rise of Ponzi-style trends, marked by the poor slowly being stuck in obtaining more, new microloans merely to repay existing microloans.

Conclusion

A country needs a thriving business sector focused on a critical mass of enterprise that is capable of achieving a minimum productive size. It can be done by implementing some state-of-the-art technology, developing some creative capacity, and connecting subcontracting.