What investors can think now?

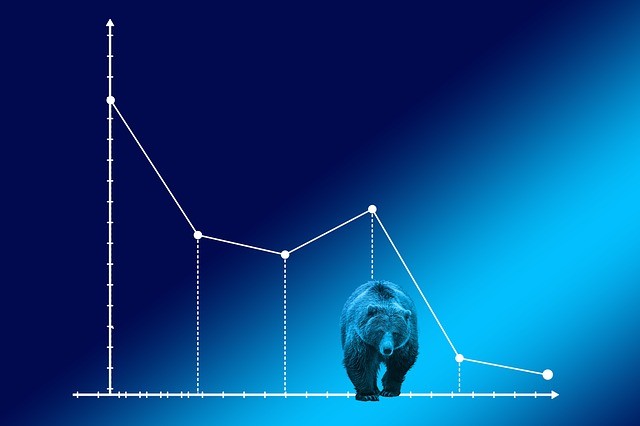

I think we can all agree that recessions in US history are set to become the longest in history. Several investors have been fearful that a recession and bear market is “overdue”. The economic fundamentals have now deteriorated to the point that a recession does indeed look likely (but 75 to 90 percent probability) within the next nine to 16 months.

This means that investors might be very afraid but now isn’t the time to panic, but rather look at the facts. What’s likely to happen to both the economy and stock market over the coming 12 to 18 months? More importantly, discover what you can do with your portfolio to not just protect your hard-earned wealth. But potentially profit from the coming bull market, which will follow the bear as surely as day follows night.

Recession Predictors

The complexity of the US economy, which is $20 trillion in size, means that perfect recession prediction is impossible. What investors can think now given the high stakes involved with economic contractions and bear markets. The most accurate recession predictor ever discovered is the famous Yield curve (or Y-curve). This has accurately predicted 90 percent of the last 10 recessions.

The 10y-2y curve, did once give a false signal when we had a severe slowdown but no official recession? What an investor can think now is watch the 10y-2y curve, which is the best forecasting tool. Moreover, being calm, sticking to your long-term model is important and if you are trading, make sure you are efficient in your trading.

Use all your Options

What investors can think now is institutionalize your order flow? Use all your options on the table, use professionals that would help a lot. Avoid buying shares of equities directly as they continue their wild swings. Also, Consider liquid alternatives, or baskets of securities with exposure to things like real estate, private equity, and hedge funds.

Options are a great thing; focus on listed options, listed index options and ETF options. What an investor can think now is understand the pricing, to put your idea on, there’s risk in selling those ideas. Mistakes do happen; educate people to understand that bad trades can be rectified. It is the best thing an investor can do in present circumstances.

What investors can think now is to take time to better educate the traders before asking for their concepts to be considered. Also, it is strange why investors are not rushing to fund your startup. The idea might not be the problem, it could be the approach. Entrepreneurs come unprepared pitching business models that don’t qualify investor funding. The promise of high returns is most attractive in an actively growing market segment.

What investors think now is to find their best deals through trusted networks or referral sources. In addition, they need to build relationships with the intermediaries who can get them good business opportunities. Investors should look for common themes that unfold exactly as expected. They look for leaders with a good business plan to survive and be successful.