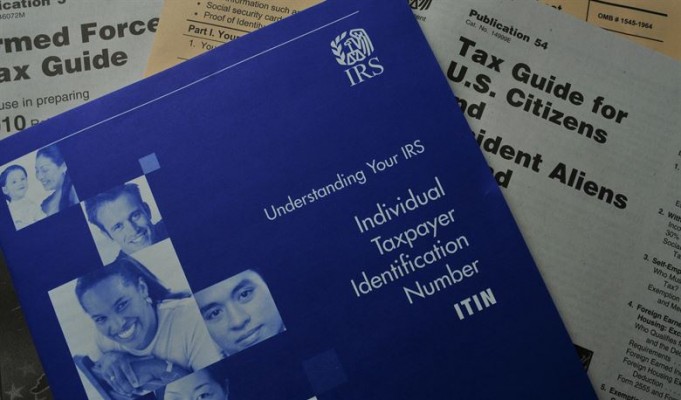

Know about ITIN Number

ITIN stands for Individual Taxpayer Identification Number. It is passed by the Internal Revenue Service (IRS) department, which handles all the tax-related procedures. ITIN works as a tax processing number for an individual. An ITIN number consists of 9 digits, the first digit is 9, and the 4th digit in the series is either 7 or 8. A working individual requires to pay taxes, and it is done via SSN. If you are not eligible to have an SSN, then you must hold an ITIN with you.

Let us go through more details about it, like why an ITIN is required.

One needs to fill form W-7 to get ITIN. The form is available both online and offline. To fill the form specific documents required-

- Identity proof of yourself

- Federal tax return

Why an ITIN number is required

When you send the federal tax return along with W-7, you do not need to send it separately to the authorities again. However, send the income tax return with the Form W-7 to the address mentioned in the form itself. So, after receiving the ITIN, you can send your tax return along with the ITIN to the addresses mentioned in Form 1040, Form 1040A, or Form 1040EZ.

Documents required with ITIN number

Proof of your residential status includes-

- Passport

- Immigration Services (USCIS) photo identification

- U.S. Citizenship certificate

- U.S. Department of State issued Visa

- Foreign military identification card

- Current national identification card (with name, address, date of birth, expiration date and photo)

- Foreign voter’s registration card

- Civil birth certificate

- Medical records (only acceptable for dependents who are over the age of 14 and under the age of 18, if a student)

- School records (only adequate for dependents under the age of 14 and the age of 18, if a student

Proof of your identity includes

- U.S. driver’s license

- Foreign driver’s license

- U.S. military identification card

- U.S. state identification card

Ways to apply for an ITIN number

In particular, one way is not enough for the government to handle all the applications for issuance of ITIN numbers. Therefore, they have made specific ways for individuals to apply for the ITIN. Moreover, not everyone is fledged with the basic requirements for filing the form. Following are the two ways to fill the application form for ITIN number:-

- Apply for an ITIN at a Taxpayer Assistance Center (TAC) by yourself

- Apply for an ITIN with a Certifying Acceptance Agent (CAA)

TAC assists as and when you walk into the center. On the other hand, the appointments can be pre-scheduled, and then you can go and visit. CAA is the body authorized by the IRS to assist individuals regarding the filling of the application form.

Obtaining an ITIN and maintaining it forthwith it a task to be handle with care because it involves a long procedure to receive it. Certain ITINs also have renewal dates and are renewed with a particular set of steps. Therefore, keep your ITIN number safe!